Mining & Mineral Processing

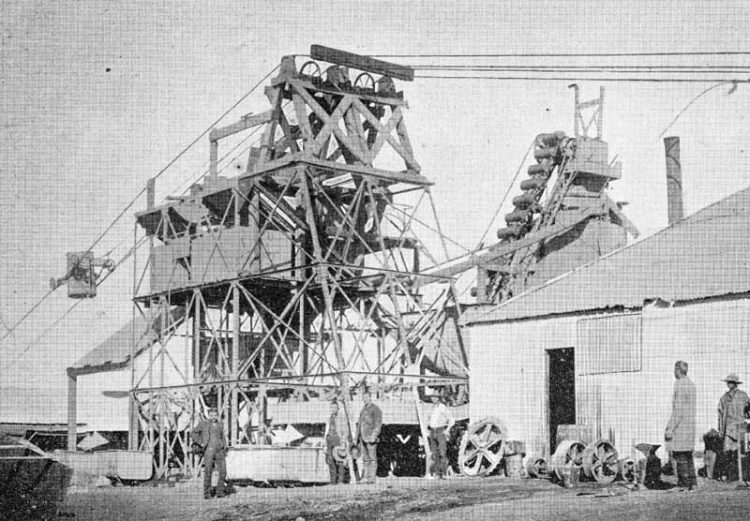

Overview

Mining and mineral beneficiation plays a pivotal part in South Africa’s economy. The country’s mineral reserves are among the most valuable in the world. South Africa has the world’s largest reserves of platinum group metals (PGMs) and manganese, and some of the largest gold, diamonds, chromite ore and vanadium deposits. South Africa’s mining industry is the fifth largest globally in terms of gross domestic product (GDP).

The mining sector contributed R356bn or 7.3% to South Africa’s GDP and accounted for 25% of the country’s total export earnings. Platinum, coal and gold are the three largest mining exports. In 2018, the mining industry contributed R93bn to fixed investment, which constituted 17% of private sector investment and 10.5% of total fixed investment, respectively. South Africa’s well-integrated mining value chain supplies inputs into various manufacturing sectors including metal fabrication, automotive and jewellery manufacturing.

Value Proposition

Rising mining depths and challenges with declining mineral ore yields have created the opportunity for the infiltration of new digital technologies, enhanced data analytics and digitisation (including 3D visualisation) to support productivity and efficiency in an era of new-generation mining for South Africa.

Several large original equipment manufacturers (OEMs), such as Komatsu, Caterpillar and Rockwell Automation, have invested in and developed automated mining solutions for deep-level underground mining operations. South Africa is at the forefront of these developments, which are expected to enhance production cost efficiencies.

There are significant growth opportunities for IT systems developers and OEM manufacturers in the digitisation and optimisation of deep and unsafe mines. Notable commercial new-generation mining projects include De Beers’ Venetia Underground Project in Limpopo, Ivanhoe’s Platreef Project in Mokopane and the Waterberg Platinum Group Metals Project north of Mokopane. Exxaro’s new Belfast Coal Mine is already producing high-grade thermal coal.

The mining and mineral beneficiation industries hold the potential to substantially contribute to economic growth, job creation, transformation and infrastructure development, consistent with the government’s objectives of inclusive growth. Given this potential, there are a range of sector-specific and general support programmes and initiatives supporting the sector. The South African 2018 Mining Charter has contributed to policy and regulatory certainty in the sector.

Support Programmes

National Incentive Programmes including the Manufacturing Competitiveness Enhancement Programme (MCEP), Capital Projects Feasibility Programme (CPFP), 12I Tax Allowance Incentive, the Global Business Services (GBS) Incentive, Critical Infrastructure Programme (CIP) and the Black Industrialist scheme (BIS).

Skills Development Support in the form of Mining Qualification Authority skills training and development, the Department of Mineral Resources internships and bursaries, Universities and Technical and Vocational Education and Training (TVET) colleges provide courses in mining engineering, artisan, geology, etc.

Special Economic Zones which are the OR Tambo Special Economic Zone (SEZ) (Gauteng) and the Makhado SEZ (Limpopo), support beneficiation of precious metals and minerals. A third location – the Bojanala SEZ (North West Province) has been earmarked as a new site for mineral beneficiation of platinum group metals.

Other support programmes include the Support Programme for Industrial Innovation (SPII), Technology and Human Resources for Industry Programme (THRIP), the Workplace Challenge Programme (WPC), the Department of Mineral Resources Small Scale Mining (DMR SSM) support programme as well as the African Mining Partnership (AMP).

Support Programmes

Given South Africa’s endowment of natural resources and its already established mining industry, there are a range of opportunities ranging from the development of resource deposits to manufacturing and beneficiation along the value chain. Key opportunities include:

Coal

Development of new coal resources, Coal-bed methane, Coal-to-liquid, Carbon capture and storage, Coal ash beneficiation (cementitious input material production), Coal ash for acid mine drainage neutralisation Uranium and thorium, Nuclear fuel fabrication Iron and steel, Supply of technologies aimed at enhancing competitiveness and Downstream manufacturing (foundries and mini-mills)

Manganese

Opportunities include the development of new manganese resources, development of value chain linkages to the global steel value chain, development of value chain linkages with global energy storage value chains Titanium, establishment of smelters and downstream production, production of titanium dioxide pigments, and the production of titanium metal for 3D printing applications.

Vanadium

The development of new vanadium resources, development of linkages to the global energy storage value chain PGMs and chrome, primary resource development in the Bushveld Igneous Complex, value chain development for catalysts and fuel cell manufacturing, and the development of ferrochrome production capacity.

Opportunities are also in the precious metals and diamonds and jewellery manufacturing

Where to invest?

There are distinctive geological structures and settings:

- Witwatersrand Basin (Gauteng, Free State, Mpumalanga, and North West): gold, uranium, silver, pyrite and osmium.

- Bushveld Complex (North West, Mpumalanga and Limpopo): PGMs, copper, nickel, cobalt mineralisation, chromium, vanadium-bearing titanium ore, fluorspar and andalusite.

- Transvaal Supergroup (Northern Cape and Limpopo): manganese and iron ore.

- Karoo Basin (Mpumalanga, KwaZulu Natal, Free State and Limpopo): bituminous coal, anthracite and shale gas.

- Phalaborwa Igneous Complex (Limpopo): copper, phosphate, titanium, vermiculite, feldspar and zirconium ores.

- Kimberlite pipes (North West and Northern Cape): diamonds Beneficiation: Most precious metal beneficiation takes place in Gauteng.

- Steel mills that process iron ore are located in Gauteng, Mpumalanga, KwaZulu Natal and the Western Cape.

South Africa has well-established infrastructure network that is geared towards the extractive industry and supports the beneficiation of minerals extracted in South Africa. The country has the largest railway network in Africa. South Africa possess key inputs for emerging technologies. According to the Department of Mineral Resources, SA holds more than 90% of global platinum group metals (PGMs) reserves and 75% of global supply. PGMs play an important role in the manufacturing of emerging fuel cell technology.

The country has world-class talent development. The Wits School of Mining Engineering at the Witwatersrand University in Johannesburg is recognised as one of the top mining engineering schools in the world. In 2018, the school was the leading mining engineering school in Africa and ranked in the Top 15 globally.

We have diverse, world-class mineral portfolio. South Africa holds some of the world’s largest reserves of precious metals, refractory metals, base metals and energy minerals. This diverse mineral reserve portfolio supports the sector’s long-term growth outlook.

We are a global leader in deep-level mining. A number of the world’s deepest mines are located in South Africa, which has led to the acquisition of unique deep-level mining expertise. AngloGold Ashanti’s Mponeng Mine is the world’s deepest gold mine reaching 3 400m below surface.

Your Local Contact

-

Brian Soldaat

- Director: Resource-based Industries

-

+27 12 394 1238

- Brians@thedtic.gov.za