Invest in Provinces

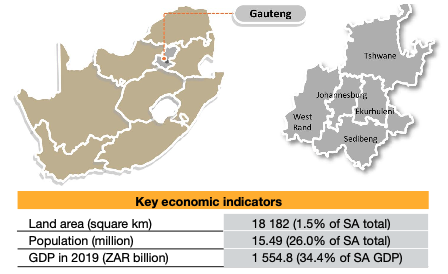

South Africa is made up of nine provinces offering a diversity of investor opportunities whether you are a potential investor or an establishment one. Some of the provinces (four) are coastal, offering ports and harbours for imports and exports but have an extensive air, road and rail infrastructure. Gauteng is the smallest province by geographical size but has the highest economic activity.

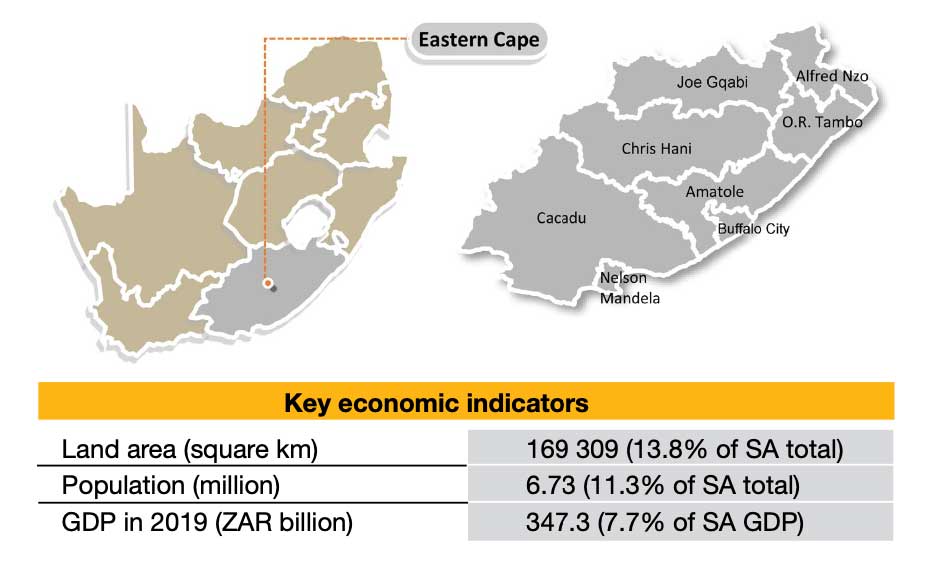

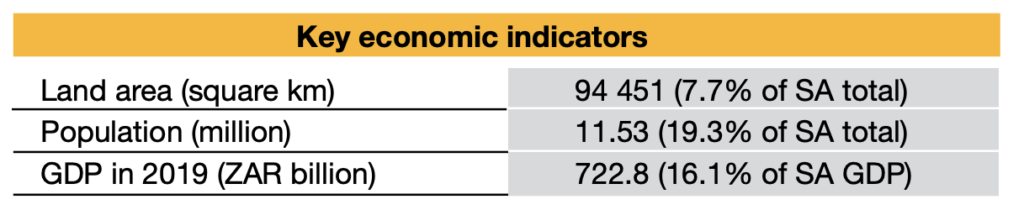

Eastern Cape

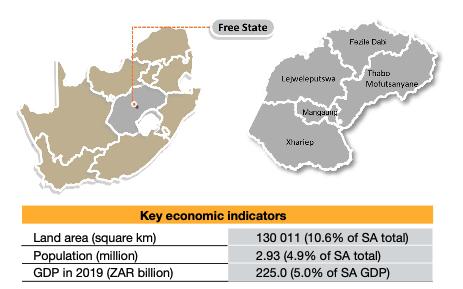

Free State

Gauteng

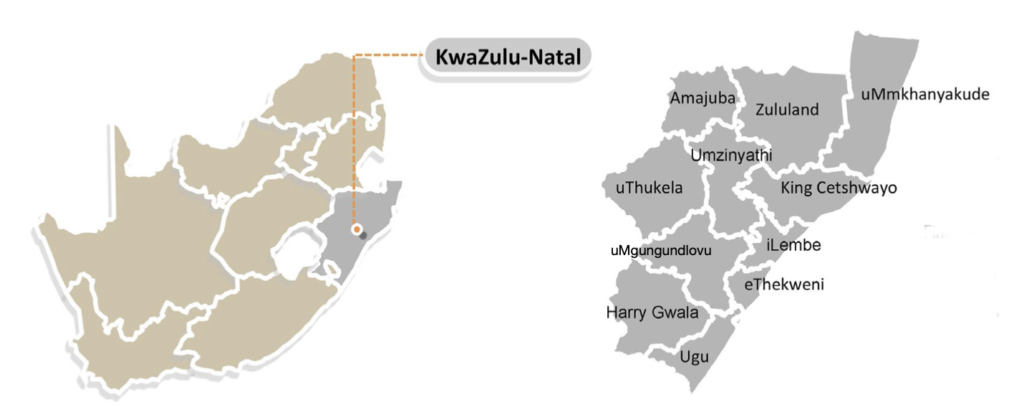

KwaZulu-Natal

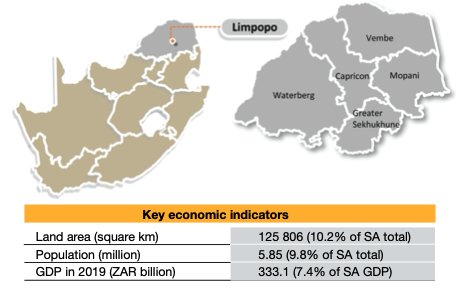

Limpopo

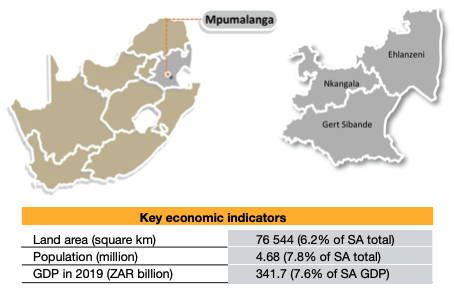

Mpumalanga

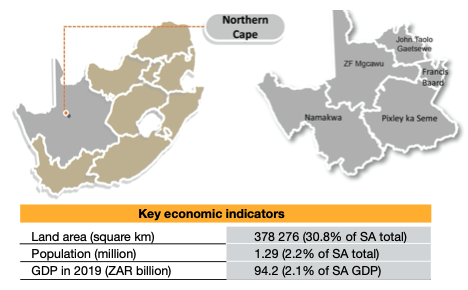

Northern Cape

North West

Western Cape

Eastern Cape

Provincial Economic and Investment Synopsis: Eastern Cape

- Strategic focus on the growth and development of maritime industries, agricultural production and agro-processing capacity, capital goods, automotive production, green industries (including renewables) and petrochemicals, among others

- Improved provision of healthcare services

- Development of integrated human settlements

- Stimulation of rural economic development (roads, water and sanitation, housing development) and driving land reform as well as agricultural production capacity

- Economic transformation to boost job creation and sustainable livelihoods

- Strategic focus on expanding export-oriented growth for local industries

Sources: IDC, Brand SA, Eastern Cape Development Corporation, Eastern Cape Provincial Government, Global Africa Network

Selected investment opportunities

- Agriculture and agro-processing (food processing and livestock)

- Transport and construction

- Export-oriented opportunities in agriculture (sheep farming) and agro-processing, leveraging off the proximity to the ports of East London and Port Elizabeth

- Transport and logistics services to support manufacturing (agroprocessing and general trade related) growth opportunities

- Tourism development potential, spanning the Sunshine Coast from the Fish River Mouth to the Wild Coast

- Services sector opportunities, including finance and business support, and infrastructure development

- Agriculture, including sheep farming and agro-processing

- Eco-tourism development

- Agro-processing potential, including tea production

- Timber processing

- Titanium mining

- Agriculture investment opportunities in meat production, wool and mohair, dairy farming, deciduous fruit production, citrus, forestry

- Tourism development potential supported by national parks, game reserves and cultural assets

- Agro-processing related to cattle and sheep farming

- Commercial forestry, wood products

- Export-oriented opportunities in the automotive value chain (vehicle assembly, manufacturing of components, parts and accessories) leveraging off the ports of Coega SEZ and Port Elizabeth

- Services opportunities (finance, insurance, R&D,education/training service providers, general business support services, BPO)

- Metals fabrication

- Manufacture of communications, medical, transport and other automotive sector related equipment

- Textiles and clothing manufacturing

- Renewable energy, gas and steam infrastructure

- Mining (manganese) and related services

- Wood products, paper, publishing

- Tourism development, including sports tourism

- Export-oriented opportunities in East London IDZ

- Agriculture and agro-processing (fertile hinterland)

- Tourism development (Sunshine Coast)

Free State

Provincial Economic Synopsis: Free State

- Leverage SEZs for economic diversification beyond mining and agriculture, with priority sectors in such zones including logistics, ICT, automotive, pharmaceuticals, agroprocessing and other manufacturing

- Diversification and expansion of agricultural base, and sector transformation

- Mitigating adverse impact of declining mining sector activity through re-use of mining infrastructure and the implementation of mine tourism initiatives

- Build sustainable human settlements and provision/ extension of healthcare services

- Increased local procurement

- Gold mining and processing supported by a vast mineral resource base that can be unlocked with furtherl investment

- Developed agriculture sector and growing chemicals industry provide attractive investment opportunities

- Gauteng – Free State – KZN and N8 development corridor presents significant opportunities in freight logistics, warehousing and storage infrastructure development

- Expanding and diversifying manufacturing production capacity beyond petrochemicals

Sources: IDC, Free State Development Corporation, Mangaung Chamber of Commerce and Industry, Free State Provincial Government, Global Africa Network

Selected investment opportunities

- Textiles and clothing value chains

- Tourism development potential leveraging off Thaba ‘Nchu

- Infrastructure development to support manufacturing and services activities

- Sunflower seed production and processing

- Tourism development potential (Highlands of Maluti Route), leveraging off steel bridge over Caledon River (a national

monument)

- Sheep farming and related processing value chain

- Sports tourism development potential leveraging off Gariep Dam (SA’s largest dam), San rock paintings and Anglo-Boer War sites

- Aquaculture activities associated with Gariep Dam

- Maize production and processing

- Jewellery beneficiation

- Tourism development potential leveraging off heritage assets

- Sasolburg chemicals complex presents attractive manufacturing and services investment opportunities

- Agro-processing in the grains value chain

- Tourism development potential leveraging off the Vaal River

and Vredefort Dome (a world heritage site)

- Fruit and sunflower seed farming and processing

- Tourism development potential leveraging off Drakensberg and various cultural assets

- Investment opportunities in Harrismith multimodal transport and logistics hub

Gauteng

Provincial Economic Developmental Focus: Gauteng

- Gauteng Growth and Development Plan aims to turn Gauteng into a seamlessly integrated, globally competitive city region

- Investment promotion in SEZs with a focus on aviation, agro-processing, jewellery manufacturing, electronics and pharmaceuticals production, among others

- Water resource risk management through green hydro energy capacity development

- Development corridor strategy to channel investment for maximum economic impact

- Accelerated infrastructure delivery to enhance service delivery and spatial transformation

- Economic transformation through township economy revitalization, release of land and integrated human settlements

- Agricultural value chain development through implementation of rapid land release programme

- Roll-out of urban renewal programme presents attractive opportunities in social infrastructure development, maintenance and retail development

Sources: IDC, Gauteng Growth and Development Agency, Global Africa Network

Selected investment opportunities

- Renewable energy generation to supply into district municipalities

- Infrastructure development for flood risk management, low cost housing

- General network infrastructure development, including rail freight, expanding ICT networks

- Services opportunities through local government partnerships (including security provision, refuse collection, solid waste recycling)

- Financial and other services

- Pharmaceuticals production and numerous manufacturing activities

- Opportunities in the green and blue economies

- Further development of the automotive and components industry

- Manufacturing capacity development to support the aerospace industry

- Broadband network development opportunities

- Agro-processing, research capacity development

- Logistics and transport investment opportunities leveraging off OR Tambo International Airport and the Johannesburg-Maputo corridor

- Aviation industry value chain development leveraging off the aerotropolis in the vicinity of OR Tambo International Airport

- Food processing and packaging

- Environmental investment opportunities in the development and maintenance of wetlands, ridges

- Property development investment opportunities

- Unlocking agricultural value chain development potential associated with vast vacant land as well as above-average underground water availability and rainfall intensity

- Agriculture investment opportunities in meat production, wool and mohair, dairy farming, deciduous fruit production, citrus, forestry

- Tourism development potential supported by national parks, game reserves and cultural assets

- Agro-processing related to cattle and sheep farming

- Commercial forestry, wood products

- Export-oriented opportunities in the automotive value chain (vehicle assembly, manufacturing of components, parts and accessories) leveraging off the ports of Coega SEZ and Port Elizabeth

- Services opportunities (finance, insurance, R&D,education/training service providers, general business support services, BPO)

- Metals fabrication

- Manufacture of communications, medical, transport and other automotive sector related equipment

- Textiles and clothing manufacturing

- Renewable energy, gas and steam infrastructure

- Mining (manganese) and related services

- Wood products, paper, publishing

- Tourism development, including sports tourism

KwaZulu-Natal

Provincial Economic and Investment Synopsis: KwaZulu-Natal

- Strategic sectoral development focus on the growth of renewable energy generation, agriculture, aloe-processing, bio-ethanol production, aquaculture, fish processing, ocean economy

- Development of innovation hubs

- Investment in the knowledge economy through ICT infrastructure development

- Strategic infrastructure development (seaports, airports, road and rail networks, sustainable water and sanitation, enhanced waste management capacity)

- Well developed infrastructure to support export growth opportunities via major seaports (Durban, Richards Bay)

- Investment opportunities in the automotive value chain, production of textiles, clothing, footwear, plastic products, chemicals, fabricated metal products, wood and wood products, appliances, machinery and equipment

Selected investment opportunities

- Automotive supply chain, chemicals value chain, food processing

- Expansion of BPO, ICT, tourism and financial services sectors

- Infrastructure development opportunities including e-waste recycling, compressed earth blocks

- Durban Point Waterfront development, hospitality sector investments such as Umgababa Beach Resort Development on the South Coast)

- Manufacturing activity in the automotive supply chain, chemicals, plastics, pharmaceuticals, food processing, clothing and textiles, leather and footwear

- Attractive opportunities in soya bean production/processing

- Polysilicon production for solar power applications

- Tourism developments leveraging off natural and historical attractions

- Development potential in eco- and cultural tourism

- Agriculture value chains (livestock, horticulture, forestry)

- Opportunities in agro-processing, such as sugar cane-based activities

- Hospitality industry development

- Tourism sector development

- Agro-processing (oil products, animal feed)

- Textiles manufacturing

- Agricultural development including vegetables, sorghum, wheat, livestock, dairy farming, forestry plantations

- Diversified agricultural (sugar, macadamia nuts, tea) and agro-processing opportunities

- Soda ash production

- Tourism sector investment

- Industrial starch production

- Agro-processing incl. pulp, horticulture, meat processing

- Metals beneficiation incl. aluminium, titanium and iron ore

- Myriad industrial development opportunities to leverage the Richards Bay IDZ incl. port optimisation services

(ship building and repair, containerisation, etc.), renewable energy related manufacturing (solar, fuel cells, biomass), development of techno parks and innovation hubs

Limpopo

Provincial Economic and Investment Synopsis: Limpopo

- Industrialisation drive through promotion and designation of SEZs, including Musina-Makhado and Fetakgomo-Tubatse, and revitalisation of industrial parks

- Agricultural infrastructure development to support agro-processing (irrigations systems, packaging facilities, processing equipment)

- Development of mining input hubs to supply goods and services to mining clusters

- Agriculture and agro-processing initiative to expand production across agricultural value chain

- Petrochemicals cluster development initiative in the Musina-Makhado SEZ

- Repositioning Limpopo as a key tourist destination, development of creative industries

Sources: IDC, Limpopo Provincial Government, Brand SA, Global Africa Network

Selected investment opportunities

- Several investment opportunities in agro-processing and the establishment of packaging facilities for products such as citrus, potatoes and tomatoes

- Significant potential in commercial-scale production of maize, tobacco, peanuts, vegetables, sunflower seeds and cotton

- Platinum mining and beneficiation potential

- Agro-processing opportunities leveraging off an established food production sector, including canned, preserved and dried fruit, as well as vegetable juices

- High yielding vegetable and fruit production in areas such as Tzaneen and Letaba Valley (mangos, avocados and tomatoes)

- Tourism sector investment potential as an important gateway to the world-renowned Kruger National Park

- Established mining production in phosphate and phosphoric acid (Foskor) has scope for further development and investment

- Primarily anchored by the district’s agriculture sector

- Vast bushveld supports commercial and game farming

- Cultural and historical assets along the Ivory Route provide a strong basis for eco-tourism investments

- Diamond mining investment potential (Venetia Mine, owned by De Beers, is SA’s largest diamond producer)

- Expansion of tea production capacity

- Mining constitutes the district’s main economic activity and its minerals-rich Bushveld Igneous Complex (platinum group metals, base metals, iron ore and tin) presenting enormous investment potential

- Coal mining opportunities in the Waterberg Coal Fields. Lephalale town is the epicenter of the district’s coal mining and power generation

- The hot springs at Bela-Bela underpin opportunities for further tourism value chain development

Mpumalanga

Provincial Economic and Investment Synopsis: Mpumalanga

- Strategic focus on beneficiation and economic diversification through manufacturing sector growth, with agro-processing as a strategic priority

- Nodal development through corridor investment in five primary nodes, namely Witbank/Emalahleni, Middelburg, Mbombela/Nelspruit, Secunda and Ermelo

- Tourism development and investment in five functional precints, namely Sabie, Graskop, Mbombela and Kruger National Park

- Forestry sector development

- Agricultural sector development through the expansion of commercial farming activities

- Infrastructure investment aimed at mining and energy related development

Sources: IDC, Brand SA, Mpumalanga Economic Development Agency, Global Africa Network

Selected investment opportunities

- Significant tourism development potential supported by valuable ecological assets, including the Kruger National Park, Blyde River Canyon and God’s Window

- Export-oriented agricultural value chain activities, including agro-processing opportunities in citrus fruit, sugar and forestry

- Manufacturing and services opportunities to support the district’s coal power generation and petrochemicals complex

- Maize processing opportunities (region is part of South Africa’s maize production triangle)

- Agro-processing opportunities in poultry, sheep, sunflower and sorghum, among others

- Coal mining and steel production

- Diverse mineral beneficiation opportunities

Northern Cape

Provincial Economic and Developmental Focus: Northern Cape

- Eradication of backlogs in water and sanitation, electricity and housing

- Provision of green infrastructure, including renewable energy (e.g. solar), water tanks

- Concentration of economic infrastructure investment in areas with potential for sustainable economic development

- Enhance regional connectivity

- Urban and rural development

- Protect and manage biodiversity, water and agricultural resources

Sources: IDC, Brand SA, Northern Cape Economic Development and Tourism, Global Africa Network

Selected investment opportunities

- Opportunities associated with the Kimberley International Diamond & Jewellery Academy

- Mine development and jewellery manufacturing opportunities in diamonds and precious stones

- Textiles production

- Agro-processing activities

- Development opportunities related to Sol Plaatjie University

- Opportunities associated with the Kathu industrial park development and the Gamagara mining corridor

- Tourism development, including eco-tourism

- Goat commercialisation

- Agro-processing, including olives, grains, pecan nuts and medicinal plants

- Acquaculture value chain development (abalone, hake, hondeklip fish)

- Export-oriented kelp related activities

- Sheep and goat processing

- Game and nature reserve development opportunities

- Small harbour development opportunities (e.g. Port Nolloth)

- Support services associated with the Square Kilometre Array (SKA) project

- Opportunities in the De Aar rail cargo hub development

- Various tourism development opportunities

- Industrial development opportunities in the Upington SEZ and the Upington cargo and electronics hub, including those targeting the SKA, the renewable energy industry

and aircraft storage - Development of Upington International Airport

- Tourism development

- Business Process Outsourcing opportunities

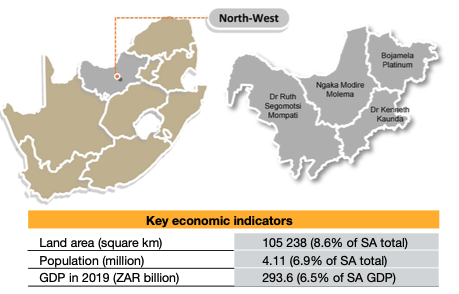

North West

Provincial Economic and Investment Synopsis: North West

- Promotion of labour-absorbing industries through SMME support, enterprise and supplier development, public and private sector procurement and the stimulation of rural economies

- Position the province as an attractive investment destination, with the SEZ as a drawing card

- Use provincial imperatives and competitive advantages to expand and diversify the export sector

- Drive infrastructure investment and service delivery to promote competitiveness

- Human capital development, training and improved utilisation of research and innovation

Sources: IDC, Brand SA, North West Development Corporation, Global Africa Network

Selected investment opportunities

- Rich, diverse natural and cultural heritage, including one of the world’s oldest meteor impact sites, presents attractive tourism investment potential

- N12 Treasure Corridor is major node for industrial, commercial and tourism development

- Large minerals resource base supports prospects for new mine development and associated minerals beneficiation projects

- Agriculture development potential from vast arable land making up ca. 50% of the province’s geographical area

- Agriculture value chain development

- Tourism development potential leveraging off the district’s historical assets

- Robust growth in Mahikeng (provincial capital) presents opportunities for social infrastructure development, general business services and financial services

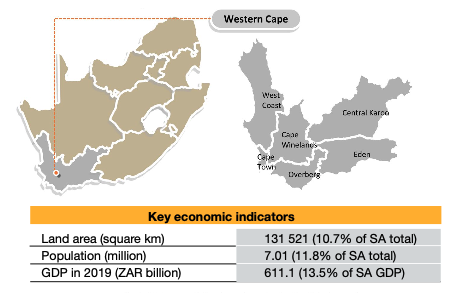

Western Cape

Provincial Economic and Investment Synopsis: Western Cape

- Key priority development sectors include agro-processing, light manufacturing, oil and gas, aviation, clean energy, business services (such as BPO), financial services, ICT, real estate, tourism, green economy related (including waste beneficiation/recycling)

- Expanded, efficient and effective provision of healthcare, education and training services

- Growth of the province’s well-established transportation and logistics network, including the provision of additional public transport services

- Encourage and stimulate research and innovation

- Numerous investment opportunities across services industries (including BPO, transport and logistics, ICT, tourism, film production, multimedia), the green economy, various agricultural value chains and related agri-technologies, as well as manufacturing activities (including petrochemicals, boat-building, clothing and textiles, among others)

Sources: IDC, Invest Western Cape, Western Cape Government, WESGRO, Global Africa Network

Selected investment opportunities

- High growth investment opportunities in business services, including BPO and ICT development

- Services sector investment opportunities abound, including financial services (Fintech, e-commerce, asset manage- ment), film and multimedia investment opportunities (Cape Town is already an internationally competitive film and media production destination), substantial tourism-related opportunities leveraging off natural and cultural assets

- Renewable energy and other green economy related opportunities (solar PV and wind energy, as well as the manufacture of related components and services provision)

- Electronics manufacturing, including satellite technology, circuit boards, medical technology, telecoms and consumer electronics

- Diversified agro-processing opportunities

- Clothing and textiles production

- Energy related opportunities (oil, gas derived from large shale gas reserves, solar power), metals and engineering services

- Tourism-related development opportunities

- Aquaculture and agricultural investment opportunities (barley, apples, canola, lucerne, pears, wheat and sheep farming, etc.)

- Renewable energy (wind, solar and wave energy generation opportunities) and biofuels

- Harbour precincts development

- Tourism sector development opportunities

- Agriculture and agro-processing (grapes, wine, wheat, rooibos tea), as well as fisheries

- Cement production, mining and mineral processing (titanium, zirconium, phosphate, limestone, sandstone, diamonds)

- First and only Energy and Maritime Services Freeport in South Africa, in the port of the SBIDZ special economic zone

- Diversified agro-processing opportunities (grapes, wine, essential oils and medicinal plants, among others)

- Tourism-related opportunities (wine, leisure, nature, sports)

- Paarl CBD redevelopment opportunities

- Agro-processing (including dried fruit, timber, macadamia nuts, vegetables, wheat processing), flora farming, agri-park development, high value organic compost fertilizer production

- Airport expansion, integrated transport infrastructure development, ICT infrastructure rollout

- Manufacturing of personal care products, lubricants and others

- Tourism sector development

Have Questions? Please feel free to reach out to us.